18 Fintech Interview Questions And Answers You Need To Know In 2024

Entering the world of financial technology, or Fintech, as a fresh graduate is an exciting prospect, but the journey begins with acing the Fintech interview questions. Whether you have experience as a FinTech specialist or you’re stepping into the sector for the first time, being successful in a FinTech job interview requires thorough preparation.

The same principle applies to employers in search of seasoned experts or fresh talent in FinTech. Planning carefully allows employers to identify specific skills, experience, and qualities needed for the FinTech role. This targeted approach enhances the likelihood of attracting candidates who align with the company’s objectives. This post will be helpful for both the interviewer and the interviewee.

Common Fintech Interview Questions

Common Fintech Interview Questions explore the essential queries that candidates may encounter when pursuing roles in the dynamic field of financial technology. From technical skills to industry knowledge, this article provides insights into the key areas employers often assess during fintech interviews.

1. What is your understanding of the concept of fintech?

Example Response:

“When any mobile app, web app, software, or technology allows people or businesses to digitally access and manage money-related stuff, it becomes fintech. Fintech stands for financial technology. Fintech is the fusion of technology and finance to improve and innovate the way we handle money. Some real-life examples of fintech are mobile payment apps like PayPal and Venmo; online banking like Chime and Ally; digital wallets like Apple Pay and Google Pay; investment platforms like Wealthfront and Betterment; and expense tracking apps like Mint and YNAB. Fintech aims to leverage technology to make financial services more efficient, accessible, and user-friendly for everyone.“

Significance of the Question:

As an interviewer, asking about the interviewee’s understanding of fintech is key. It verifies if they understand the fundamentals. It shows how well they explain complex ideas to different people. It also tests if the interviewee is aware of the current trends in fintech to ensure they stay updated with industry advancements.

2. Have you ever worked on any fintech projects?

If you’re a fresh graduate without practical experience in fintech projects, you can be honest and emphasize your theoretical knowledge and enthusiasm to apply it in a professional setting. Certifications related to finance, computer science, information technology, business, economics, or a related discipline can enhance your credentials. When preparing for a fintech interview, it’s crucial to familiarize yourself with common fintech interview questions for freshers, showcasing your understanding of key concepts and your ability to apply theoretical knowledge to real-world scenarios. This proactive approach demonstrates your eagerness to learn and adapt to the dynamic fintech industry.

Example Response for Freshers:

“I haven’t had the opportunity to work on fintech projects in a professional capacity as I’m a recent graduate. However, during my academic journey, I actively engaged with fintech concepts and completed relevant coursework. I am eager to apply my theoretical knowledge to real-world situations, and I’m confident that my strong foundation in fintech, combined with my willingness to learn, will allow me to contribute effectively to any fintech projects in the future.”

Example Response for Experts:

“Yes, I have had the opportunity to work on a fintech project during my previous role at Boomdevs. In that project, I was a software developer. The name of the project was Flash, which is an online trading website. The flash trading website launched on time and was praised for its appealing design and user-friendly interface, boosting engagement. Traders enjoyed a seamless experience with real-time updates that were scalable to handle a growing user base and transactions. Secure payment gateways ensured smooth transactions, leading to increased registrations, traders, and revenue. BoomDevs’ collaboration with Flash solidified them as a trusted partner for intricate website development projects.

Significance of the Question:

This is an important question for fintech recruitment. It’s proof that they’ve actually worked on a fintech project in real life. It provides insights into their specific contributions to fintech projects, hands-on skills, familiarity with industry tools, showcasing their role, responsibilities, and impact, and problem-solving abilities within the fintech landscape.

3. In your opinion, what are the main challenges fintech startups face, and how would you solve them?

Example Response:

“In the world of startups, getting money (venture capital) is a big task. It’s also tough to compete with big, well-known brands. Finding a good investor can be a challenge too. Some startups face problems because they don’t have enough tech knowledge. They also face challenges like regulatory hurdles and cybersecurity risks. To tackle these challenges, my approach includes staying proactive on regulatory changes, creating a strong business plan, networking for funding opportunities, building a diverse team, creating a welcoming workplace for talented staff, seeking mentorship, prioritizing user feedback, keeping users happy and interested, and being open and protective of customer information to build trust. These are crucial for the success of a startup.“

Significance of the Question:

Asking fintech candidates about the main challenges and solutions for startups is crucial. It helps the interviewer understand their awareness of industry issues, problem-solving skills, and adaptability to the fast-paced fintech world. Their responses reveal practical approaches, showcasing how they would use their knowledge to tackle real-world challenges. It provides insights into their innovative thinking, communication abilities, and alignment with the company’s values. This question is a key tool in identifying candidates who not only understand the fintech landscape but also possess the skills and mindset to navigate and contribute to its growth.

4. What about this particular role attracts you?

Example Response:

“I’m truly excited about this role because it brings together my passion for finance and technology. The opportunity to work in the fintech industry, where innovation is constantly reshaping how we approach financial solutions, is something that I find incredibly motivating. I’m particularly drawn to this role because it aligns perfectly with my skills in [mention relevant skills] and provides the chance to contribute to [mention specific technologies or projects]. The fintech space is known for its dynamic nature, and I’m eager to adapt to emerging trends and be a part of creating solutions that address industry challenges. Additionally, the focus on [mention any company-specific goal or mission], particularly in [mention a specific area of fintech], resonates with my desire to make a meaningful impact. I’m enthusiastic about the learning opportunities this role offers, allowing me to stay at the forefront of fintech advancements and contribute to the success of the team.”

Significance of the Question:

This is the perfect opportunity for the interviewer to understand your specific interests and motivations for applying. This inquiry allows the interviewer to gauge how well your skills, career goals, and personal values align with the responsibilities and opportunities presented by the job and how you believe your strengths uniquely qualify you for the position. It helps the interviewer assess your level of preparation, enthusiasm, and commitment to the potential contributions you can make within the organization.

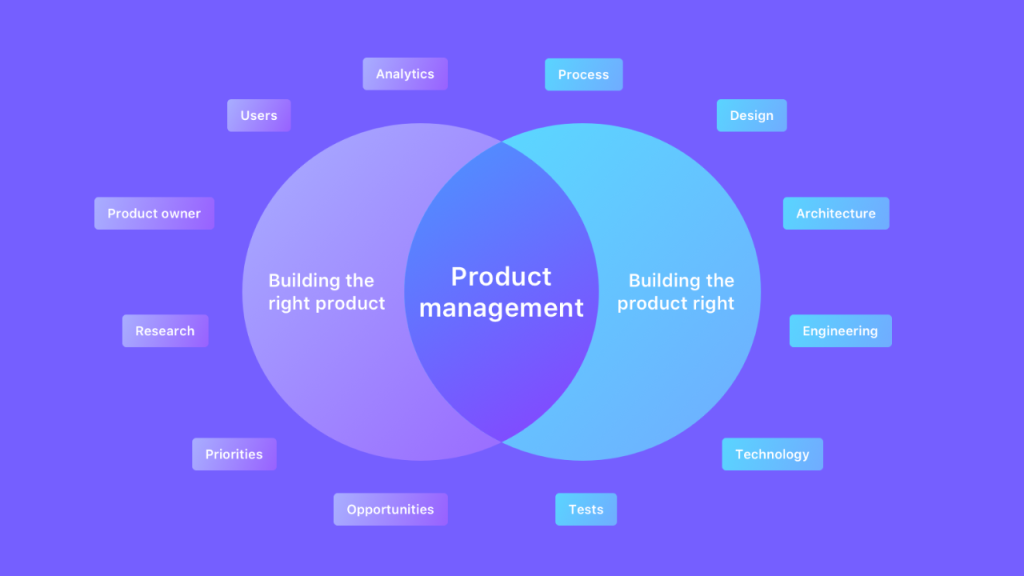

Product Manager Fintech Interview Questions

Getting ready for a Fintech Product Manager interview? Brush up on essential skills by exploring common fintech interview questions. This will help you showcase your expertise in product management while addressing specific challenges within the financial technology sector.

5. In your role as a fintech product manager, which product stands out as the most successful?

Example Response:

“One standout success in my role as a fintech product manager has been our mobile banking app. It not only surpassed key performance indicators, such as increased user engagement and transaction volumes, but also received positive feedback for its user-friendly interface. I played a pivotal role in its success by strategically shaping its features, collaborating with the development team, and aligning our efforts with the company’s goal of enhancing the customer experience. The app’s measurable achievements underscore my ability to drive impactful results as a product manager in the fintech domain.”

Significance of the Question:

By prompting the candidate to highlight a specific successful product, it allows them to demonstrate their strategic contributions and impact.

6. What methods and steps do you employ to launch a new fintech product?

Example Response:

“In the fast-paced world of fintech, staying competitive is a strategic dance. We keep a close eye on what our competitors are up to, diving into analytics for sharp insights. Customer feedback is gold, gathered through surveys and interviews, helping us understand their needs. Before launching anything big, we play it smart by testing with a small group of users to ensure a smooth ride. Now, when it comes to fintech specifics, launch and post-launch monitoring, strategic marketing, compliance, security, market research, and identifying the target audience are our guiding stars. It’s about adapting swiftly and offering what customers really want.“

Significance of the Question:

This question is important for fintech recruitment because it checks if the candidate knows how businesses stay competitive, focusing on things like understanding customers and keeping an eye on what others are doing.

7. Who are our competitors?

Example Response:

“In my role as a product manager, I’ve delved into extensive market research to comprehend our competitive landscape. I’m familiar with some key players, I took product management consultancy from them. They have plenty of fintech products that dominate the fintech market. Understanding their strategies will empower me to capitalize on our strengths, address market gaps, and actively contribute to crafting them to make our products stand out like them. Could you provide additional details on how the company views its competitors and any specific focus areas?”

Significance of the Question:

Effective responses during fintech interview questions reveal a candidate’s research prowess and their ability to leverage that knowledge to elevate the company’s products. Identifying individuals who comprehend the market intricacies and can strategically contribute to the competitive advantage is crucial. Therefore, asking targeted fintech interview questions helps gauge a candidate’s depth of understanding and potential impact on product differentiation.

8. What Do You Think Are the Most Exciting Fintech Trends Right Now?

Example Response:

“In the rapidly evolving fintech landscape, several trends are catching my attention. Embedded finance is reshaping traditional banking services, while the Buy Now, Pay Later (BNPL) model is transforming consumer payment experiences. Open banking’s collaborative approach and the innovative use of blockchain are also making waves. Additionally, the emphasis on cybersecurity, the rise of digital-only banking, and the integration of artificial intelligence (AI) and machine learning (ML) are creating exciting opportunities for transformative financial solutions.”

Significance of the Question:

This helps the interviewer by checking if the candidate knows important fintech trends, ensuring they match the company’s need for someone who thinks ahead and stays informed. It assures the candidate can bring useful ideas to navigate the changing fintech landscape successfully.

Software Developer Fintech Interview Questions

In the world of fintech, software engineers are essential for driving innovation. As you get ready for a discussion on fintech interview questions, remember their crucial role in shaping the technology that powers financial advancements.

9. What key technical skills do you have for fintech as a software developer?

Example Response:

“I bring a strong technical foundation to fintech software development. In terms of core skills, I am proficient in [mention programming languages], have a solid understanding of data analysis and SQL, and follow best practices in software development methodologies. Specifically in the fintech realm, I have hands-on experience with blockchain technology, machine learning, and AI, which I believe can contribute to innovative solutions in this dynamic industry. My commitment to cybersecurity is evident in my previous work securing financial data and applications. I have successfully integrated APIs in past projects to enhance financial services, and my expertise in cloud computing includes working with [mention specific platforms]. Additionally, my quantitative analysis skills, coupled with my mobile development experience, make me well-equipped to tackle the multifaceted challenges in fintech software development.“

Significance of the Question:

For fintech recruiters, asking a software developer about their key technical skills is crucial. It ensures the candidate has the right skills for fintech’s unique demands, like adapting to new tech and understanding cybersecurity. The question also checks if they can handle specific tasks like API integration, quantitative analysis, and mobile development—essential for fintech success. Overall, it helps recruiters quickly assess if the candidate is a good fit for the challenges of fintech software development

10. What programming languages are frequently used in the fintech industry?

Example Response:

“In fintech, Python is widely utilized for data analysis and statistical modeling. Java plays a key role in building robust and scalable backend systems for fintech applications. JavaScript is crucial for front-end development, enabling the creation of interactive and user-friendly interfaces for online banking and financial platforms. C++ is often chosen for high-performance applications, especially in areas like algorithmic trading, where speed and efficiency are critical. These languages cover diverse needs in the industry.“

Significance of the Question:

It helps ensure they possess the necessary technical skills to contribute effectively to the dynamic landscape of financial technology.

11. Do You Think Python Is Suitable for Fintech? Why or why not?

Example Response:

“Absolutely. I believe Python is highly suitable for fintech, and here’s why. Python’s simplicity and comprehensible syntax make it ideal for the fast-paced and complex nature of the financial industry. It excels at addressing specific fintech requirements such as data regulation, analytics, and compliance due to its versatility. Python’s flexibility is particularly beneficial for both qualitative and quantitative data analysis, offering a robust solution for handling and processing large financial datasets efficiently. Overall, Python’s strengths align seamlessly with the diverse needs and challenges of fintech, making it a highly suitable choice for developers in this field. SQL is essential for managing and querying databases in fintech. It’s used for storing and retrieving financial data and supporting operations critical to banking and financial analysis.”

Cybersecurity Fintech Interview Questions

In fintech, strong cybersecurity is vital for safeguarding financial systems. Recognizing the importance of cybersecurity is key as you prepare for fintech interview questions.

12. What are the challenges of fintech cybersecurity?

Example Response:

“FinTech companies have transformed how we handle finances, providing convenience and accessibility. Nevertheless, this transformation has brought about numerous cybersecurity risks that pose threats to the integrity and security of financial systems. Malware attacks, money laundering risks, third-party risks, data breaches, compliance with regulations, API vulnerabilities, DDoS attacks, insider threats, and mobile security risks are some common cybersecurity risks faced by the FinTech industry.“

Significance of the Question:

When hiring a cybersecurity specialist for a fintech company, it is important to check if the candidate is aware of cybersecurity risks.

13. How Would You Solve Fintech Cybersecurity Risks As A Cybersecurity Specialist?

Example Response:

“I would implement advanced threat detection systems and regularly update antivirus software to swiftly identify and neutralize malware threats. To combat money laundering risks, I’d deploy robust transaction monitoring systems and establish effective Know Your Customer (KYC) procedures. Thorough security assessments of third-party vendors, ensuring they adhere to stringent cybersecurity standards, would be a priority to mitigate third-party risks. For data breaches, my approach involves implementing encryption protocols, conducting regular security audits, and enforcing strict access controls. By staying informed about evolving regulations, I would ensure our cybersecurity practices align with industry standards and compliance frameworks to maintain regulatory compliance. To address API vulnerabilities, I regularly assess and secure APIs, implementing encryption and authentication mechanisms to safeguard against potential security gaps. To mitigate DDoS attacks, I would leverage advanced protection services, implement traffic filtering, and maintain redundancy. Combating insider threats involves implementing user behavior analytics, conducting regular internal audits, and enforcing strict access controls. For mobile security, I’d implement mobile device management solutions, enforce secure coding practices for mobile applications, and conduct user education programs on mobile security best practices. These measures collectively aim to fortify the company’s defenses against a range of cybersecurity challenges, ensuring the integrity and security of our financial systems.“

Significance of the Question:

It helps check if the candidate can solve cybersecurity threats for specific problems in a smart way.

14. What Is GDPR, and What Do You Know About It?

Example Response:

“GDPR, or the General Data Protection Regulation, is like a set of rules for how companies should handle personal information. It gives people more control over their data and makes sure companies use it in the right way. GDPR wants companies to be clear about what data they collect, why they collect it, and how they use it. It also gives people the right to know what information companies have about them and to ask them to delete it if needed. GDPR helps protect our privacy and makes sure companies use our information responsibly.“

Significance of the Question:

This is vital for fintech interview questions. It gauges the candidate’s understanding of GDPR, a crucial regulation for ensuring responsible and compliant handling of sensitive financial data. Knowledge of GDPR is essential for roles involving data protection and privacy in the fintech sector.

Blockchain Fintech Interview Question

Fueled by decentralized ledgers, FinTech leverages blockchain for enhanced transparency and efficiency, making it crucial to grasp its integration for upcoming FinTech interview questions.

15. What is blockchain technology, and how is it related to fintech?

Example Response:

“Blockchain technology, in the context of fintech job interview questions, is a decentralized system that securely records and verifies transactions across multiple computers. It has revolutionized financial transactions by enhancing trust and efficiency. In fintech, blockchain finds extensive application in areas such as payment processing, smart contracts, and asset management. Its decentralized nature ensures transparency, security, and immutability of financial data, making it a cornerstone technology for modern fintech solutions. The utilization of blockchain in fintech not only streamlines operations but also boosts trust and reliability in financial services.”

Significance of the Question:

A good answer shows industry awareness, problem-solving skills, and the ability to explain tech in simple terms. It’s a key question to see if the candidate fits well into a fintech role.

16. How does a fintech company leverage the skills of a blockchain engineer?

Example Response:

“In a fintech company, my role as a blockchain engineer is pivotal in several key aspects. I contribute by developing decentralized systems and utilizing blockchain’s security features to safeguard financial data. Implementation of smart contracts streamlines processes and minimizes errors, enhancing overall efficiency. My expertise extends to integrating cryptocurrencies, enabling the company to offer innovative financial services such as digital payments and tokenized assets. I also play a crucial role in optimizing blockchain solutions for scalability and performance, ensuring seamless integration with existing systems. Overall, my contribution empowers the fintech company to embrace cutting-edge technologies, enhance security, and explore new avenues for innovation in the ever-evolving fintech landscape.”

Significance of the Question:

To understand how well the interviewee comprehends the practical applications of blockchain technology in the company’s operations. This question helps assess the candidate’s awareness of how their skills align with the company’s needs and how they can contribute to enhancing fintech solutions using blockchain.

17. How do you see the future of cryptocurrencies?

Example Response:

“I envision a promising future for cryptocurrencies as transformative forces in the financial landscape. Their potential to revolutionize traditional banking through secure and transparent transactions is substantial. However, for cryptocurrencies to reach their full potential, advancements in regulatory frameworks and technological infrastructure are essential. As more individuals embrace digital currencies and regulations become clearer, the widespread adoption of cryptocurrencies is likely. Despite challenges such as price volatility and regulatory uncertainties, I believe overcoming these obstacles will pave the way for cryptocurrencies to play an increasingly integral role in shaping the future of finance.“

Significance of the Question:

It helps to see if the candidates have cool ideas about where finance and tech are headed. It also shows if they’re good with new technology and can think smartly about using cryptocurrencies. Recruiters also want to know if they get the risks, like prices going up and down. They want to see if the fintech candidate’s thoughts match what’s happening in finance now and if they’re good at thinking up new stuff.

Fintech Java Interview Questions

Navigating Fintech Java interview questions is crucial to understanding the pivotal role Java plays in financial technology. Java’s versatility and reliability make it indispensable for crafting secure and scalable solutions, emphasizing the significance of mastering Fintech Java Interview Questions for professionals in the industry.

18. How can Java’s cryptographic libraries be effectively utilized in a fintech application to ensure secure data transmission and storage?

Example Response:

“To optimize Java’s cryptographic libraries in a Fintech application, prioritize data encryption for secure transmission and establish robust key management. Utilize Message Authentication Codes (MACs) to ensure data integrity and implement secure hashing, especially for sensitive information. Integrate digital signatures to authenticate financial transactions, collectively enhancing security and instilling user trust in the FinTech system.“

Significance of the Question:

During a Fintech interview, the interviewer might pose Fintech interview questions related to the use of Java’s cryptographic libraries. These inquiries serve to assess the interviewee’s comprehension of security practices within financial technology applications. The questions aim to evaluate the candidate’s familiarity with encryption, key management, and other cryptographic techniques crucial for safeguarding sensitive financial data.

Final Thoughts

The framework of fintech interview questions provides a glimpse into the types of inquiries one could encounter during a fintech job interview. These questions serve as valuable guides, offering insights into effective strategies for crafting responses during an interview. In the realm of interview questions, there aren’t definitive right or wrong answers.

If you’re keen on delving deeper into interview dynamics within the Fintech sector, or if you are looking for any services related to fintech feel free to reach out to us.