Imagine sending money anywhere in the world with just a few taps—no hassle, no waiting. Building a money transfer app that meets user expectations requires careful planning, advanced technology, and a seamless user experience. This guide on how to create a money transfer app will walk you through each step to ensure your app is both user-friendly and highly secure. From core features to must-have integrations, we’ll cover all you need to know to stand out in the market.

Let’s start by exploring what is a money transfer app and the overview of the money transfer app market.

What is Money Transfer Software?

Money transfer software is a digital tool that enables users to send and receive money electronically. This software is designed to handle secure financial transactions between individuals or businesses, whether locally or internationally. Users can link their bank accounts, credit cards, or digital wallets to the platform for easy, quick payments.

The software typically includes security features, like encryption and authentication, to protect user data and prevent fraud. Many money transfer applications also offer options for tracking transactions, currency conversion, and integration with other financial services. This makes transferring funds convenient and accessible from anywhere, anytime.

Money Transfer App Market Overview

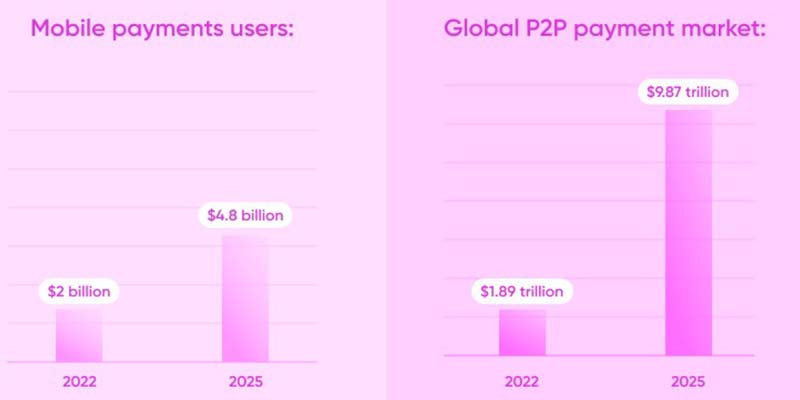

The popularity of mobile payments has surged, with over 2 billion active users recorded in 2022. This number is projected to climb significantly, reaching around 4.8 billion users worldwide by 2025.

The global peer-to-peer (P2P) payment market also shows impressive growth. In 2021, it was valued at approximately $1.89 trillion. According to a report from Precedent Research, this figure is expected to soar to nearly $9.87 trillion by 2030. This growth translates to a 20.16% compound annual growth rate (CAGR) from 2022 through 2030, highlighting the robust demand and future potential for digital money transfer solutions globally. Source: precedence research

Read More: Best Real Estate Investment Software

Types of money transfer apps

Money transfer apps come in two main forms, each offering unique advantages to users and developers alike: independent services and built-in services. Understanding these types will guide you in deciding which model best suits your app goals and user needs.

1. Independent Services

Independent money transfer apps operate as standalone platforms, allowing users to send, receive, and manage money without needing to link to another app or banking interface. These apps are highly flexible, supporting multiple currencies and often allowing transfers across borders. Independent services like PayPal and Western Union have become popular for their wide reach, easy onboarding, and enhanced security features. These apps also offer advanced features like multi-currency wallets and fraud detection, making them a go-to for global transactions.

2. Built-In Services

Built-in money transfer services are integrated within existing apps or platforms, often from banks or social media networks. These services provide seamless, in-app transactions where users don’t need to download a separate app. Examples include Zelle, integrated within many U.S. banking apps, and Facebook Pay, embedded in social platforms. Built-in services benefit from high user trust, as transactions occur within familiar apps, and are ideal for peer-to-peer transfers among existing contacts.

Each type offers distinct benefits, whether through standalone functionality or the convenience of in-app transactions. Choose wisely based on your app’s target audience and goals.

Key Features of a Money Transfer Application

We’ve already covered the types of money transfer apps, giving you insights into independent services and built-in services. Now, let’s dive into the key features of a money transfer app that make it both user-friendly and secure. Each feature below is essential for ensuring a smooth and trustworthy experience for your customers.

1. Easy Registration and Verification

An effortless registration and verification process helps new users onboard quickly. Including options for biometric login (like fingerprint or face ID) adds extra security and convenience. A streamlined KYC (Know Your Customer) process also builds trust, making it easy for users to get started.

2. Real-Time Money Transfers

Real-time transfers are a must-have feature in a money transfer app. Users expect instant transactions that let them send and receive funds without delay. This feature boosts user satisfaction and sets your app apart in a competitive market.

3. Multi-Currency Support

For a global user base, multi-currency support is vital. Allowing users to transact in different currencies expands your app’s reach and enhances its appeal to international customers. Currency conversion tools also add value for cross-border transfers.

4. Transaction Tracking and Notifications

Real-time transaction tracking and notifications keep users informed every step of the way. From payment confirmation to delivery status, timely updates add transparency. Push notifications also remind users of account activity, boosting both engagement and trust.

5. Strong Security Measures

Ensuring top-notch security is crucial. Features like end-to-end encryption, two-factor authentication, and fraud detection systems protect user data and prevent unauthorized transactions. Security is a key selling point for any money transfer app, especially for apps handling high transaction volumes.

6. Transaction History and Insights

Detailed transaction history allows users to easily track their spending. Adding insights, like monthly spending summaries or budget tracking, enhances usability and encourages financial awareness. This feature builds customer loyalty by helping users better manage their finances.

7. Customer Support Integration

In-app customer support options, such as live chat, email, or AI chatbots, make it easy for users to resolve issues quickly. Offering responsive support shows your commitment to user satisfaction and helps to address any concerns promptly.

With these essential integrations for money transfer software features, your app will be well-equipped to meet user demands, ensuring both convenience and security in every transaction.

How Do Payment Apps Work?

Payment apps simplify sending and receiving money, making transactions fast and easy. Here’s a natural breakdown of how these apps work, step by step:

1. Account Registration and Verification

Users start by creating an account on the payment app. This usually involves providing an email, phone number, or linking a bank account. The app verifies this information to ensure security and compliance. Some apps may also require additional identity verification through government IDs or biometric scans.

2. Linking a Payment Method

Once registered, users link a payment method to their account, like a credit card, debit card, or bank account. This step allows users to transfer funds directly from their bank or card to the app.

3. Initiating a Transaction

To send money, users select a contact within the app, enter the desired amount, and confirm the transfer. Many apps also allow users to scan QR codes for instant payments, which makes it easy to pay at physical stores or send money to other users.

4. Authentication and Security Checks

Before processing, the app performs authentication checks, often requiring a PIN, password, or biometric confirmation. Some apps use advanced security measures, like encryption and fraud detection, to ensure that only authorized users complete the transaction.

5. Processing the Payment

Once confirmed, the app processes the payment by deducting the specified amount from the user’s linked bank account or card. The funds are then securely routed to the recipient’s account. Depending on the app and region, this process can be instant or take a few hours.

6. Notification and Transaction Record

After completion, both the sender and recipient receive a notification confirming the payment. The app records the transaction details in the user’s transaction history, which is accessible at any time. This feature helps users track spending and manage finances easily.

7. Withdrawal Options for Recipients

The recipient can keep the funds in their payment app wallet or transfer them to a linked bank account. Many apps allow users to use these funds directly from the app for other transactions, offering flexibility.

By following these steps, payment apps make digital transactions quick, secure, and convenient for users worldwide.

Now, this is high time we talked about creating a money exchange app.

Related: Fintech Mobile App Development

How to create a money transfer app in 9 steps

We have already talked about the essential integrations for money transfer software, we will now dive into a step-by-step guide on how to create a money transfer application. Each phase below outlines critical steps and timeframes to help you bring your app vision to life.

Step 1. Analyze Business Needs and Elicit Requirements

Duration: 1–3 weeks

Begin by understanding your business goals and user needs. Identify core features and outline the app’s primary functionality. This phase sets the foundation for development.

Step 2. Create a Detailed Project Plan

Duration: 1–2 weeks

Craft a roadmap that includes milestones, timelines, and resource allocation. A detailed project plan ensures that every team member understands their role and keeps the project on track.

Step 3. Design a Money Transfer Application

Duration: 3–6 weeks

Develop a user-centric UI/UX design that emphasizes simplicity and security. This phase focuses on creating wireframes, layouts, and an intuitive interface for an optimal user experience.

Step 4. Select an Optimal Tech Stack

Duration: 2–3 weeks

Choose a reliable tech stack that supports scalability and security. Whether using React Native for mobile or a robust backend for data processing, this step is vital for long-term app performance.

Step 5. Develop and Test the Application

Duration: 4–7+ months

Start coding the app’s core functionality and conduct rigorous testing to detect bugs early. This step ensures your app is stable, secure, and user-ready upon launch.

Step 6. Establish App Integrations

Duration: 2–5 weeks

Integrate essential services like bank APIs, payment gateways, and customer support tools. Integrations enhance functionality, ensuring smooth transactions and a complete user experience.

Step 7. Deploy the Application to Production

Duration: 1–3 weeks

Launch your money transfer app on app stores or web platforms. This phase includes final checks and optimizations to ensure a smooth launch for end-users.

Step 8. Handle After-Launch Support and Evolution

Duration: Continuous

Provide ongoing app support to resolve issues, add new features, and improve user experience based on feedback. This continuous support keeps your app competitive and user-friendly.

Step 9. Gather User Feedback and Optimize

Duration: Continuous

Collect user feedback to assess app performance and identify areas for improvement. Regularly update and optimize based on this feedback to keep the app relevant and reliable.

Following these steps will ensure a successful journey from concept to launch, setting your app up for sustained growth and user satisfaction.

Read More: Best Real Estate Transaction Management Software

Timeline Projection, Estimated Cost, Team, Group

| Category | Details |

|---|---|

| Timelines: | 6–12 months on average. |

| Cost: | $100,000–$350,000+, actually it depends on the solution’s complexity. |

| Team: | A project manager, a business analyst, a solution architect, a UX/UI designer, a DevOps engineer, a back-end developer, a front-end developer, a QA engineer. |

| User groups: | Individuals, businesses from any industry, money transfer service providers (agents from a financial sector). |

Why Building a Money Transfer Application Gets Costlier

When a client comes to an agency, their main concern goes to how much does it cost to build a custom money transfer app?

Based on Boomdevs’s experience, the cost to develop a money transfer application typically ranges from $100,000 to $1,000,000 or more. This variation depends on several critical factors that influence the project’s total investment.

The sourcing model is one key factor, as costs will vary depending on whether development is handled in-house or outsourced. Each model comes with its unique expenses and benefits, affecting overall costs.

The type of app—whether web-based or mobile—also plays a role. For mobile apps, additional costs depend on supported platforms such as iOS, Android, or cross-platform options. These choices directly impact the budget due to development complexity.

The number and complexity of functional modules are another significant cost driver. Complex features, advanced security, and payment functionalities can require extensive development time and expertise.

Additionally, the number and complexity of integrations influence costs, especially when connecting to multiple financial or banking systems. User roles and UI/UX requirements also add to the cost, as each role may demand a tailored interface and unique user experience.

Performance requirements, such as scalability, availability, and security, are crucial considerations for apps with high user demands, impacting both initial and ongoing development expenses.

Finally, fees for cloud services, prebuilt app components, integration APIs, and security tools are essential to include in the budget, as they provide the necessary infrastructure and functionality for a successful app.

Benefits of Using A Money Transfer App

Now that we’ve covered the steps to create a money transfer app, let’s look at the benefits of using a money transfer app for both users and businesses. These advantages make digital money transfer solutions an essential tool in today’s financial world.

1. Speed and Convenience

Money transfer apps allow for instant transactions at any time, removing the need for bank visits. This speed and ease of use make them a go-to solution for people needing quick, reliable transfers.

2. Cost-Effective

Using a money transfer app can reduce fees compared to traditional banks. Many apps offer lower transaction costs, particularly for international transfers, making it affordable for users.

3. Enhanced Security

With features like encryption and two-factor authentication, money transfer apps offer strong security. This keeps user data and funds safe, which builds trust and encourages regular use.

4. Access to Transaction History

Users can view transaction history easily, helping them track spending and manage budgets. This transparency is especially useful for those handling multiple transfers or tracking financial activity.

5. Multi-Currency Support

For international transfers, money transfer apps often include multi-currency support. Users can send or receive funds in different currencies, making the app a convenient tool for global transactions.

6. Flexibility Across Platforms

Most money transfer apps are available on mobile and desktop, allowing users to send funds from anywhere. This platform flexibility means users aren’t limited to specific devices, enhancing accessibility.

7. Real-Time Notifications

With real-time notifications, users are always aware of their transfer status. These updates provide peace of mind and ensure transparency throughout the transaction process.

Money transfer apps combine speed, security, and flexibility, meeting the demands of modern users while offering an effective solution for businesses looking to streamline transactions.

Read more: The Benefits of Real Estate Tokenization

Key Challenges to Overcome

After discussing the benefits of using a money transfer app, it’s also essential to understand the key challenges to overcome and the latest trends in money transfer app development. Knowing these can help you navigate potential hurdles and stay competitive in the evolving fintech market.

| 1. Security and Compliance: Ensuring security is one of the biggest challenges in money transfer app development. With sensitive user data and financial transactions involved, implementing strong encryption and meeting compliance standards like AML and KYC are crucial. It also requires regular updates. | Cross-Border Transactions: Handling cross-border transactions can be complex due to fluctuating exchange rates and varying fees. Overcoming this challenge means choosing reliable currency exchange providers and developing a transparent fee structure that users can trust. |

| 3. User Trust and Adoption: Building user trust is essential but challenging in the financial sector. Offering transparency, easy-to-understand terms, and robust customer support can help overcome skepticism and encourage app adoption. | 4. App Scalability: As user numbers grow, your app must be able to handle high traffic and larger transaction volumes. Scalability is crucial, requiring efficient backend architecture and infrastructure planning to support growth. |

1. Security and Compliance

Ensuring security is one of the biggest challenges in money transfer app development. With sensitive user data and financial transactions involved, implementing strong encryption and meeting compliance standards like AML and KYC are crucial. Staying compliant also requires regular updates to meet changing regulations.

2. Cross-Border Transactions

Handling cross-border transactions can be complex due to fluctuating exchange rates and varying fees. Overcoming this challenge means choosing reliable currency exchange providers and developing a transparent fee structure that users can trust.

3. User Trust and Adoption

Building user trust is essential but challenging in the financial sector. Offering transparency, easy-to-understand terms, and robust customer support can help overcome skepticism and encourage app adoption.

4. App Scalability

As user numbers grow, your app must be able to handle high traffic and larger transaction volumes. Scalability is crucial, requiring efficient backend architecture and infrastructure planning to support growth.

Money Transfer App Development Trends

Money transfer app development is rapidly advancing to meet modern user demands. Key trends like blockchain and AI integration are setting new standards for security, speed, and user experience in digital transactions. Let’s know some of the trends.

1. Blockchain Integration

Blockchain technology is revolutionizing money transfers by offering increased security and faster, low-cost transactions. Integrating blockchain can attract users looking for safe, transparent, and quick transfers, especially for international payments.

2. AI and Machine Learning

AI-driven fraud detection and personalized recommendations are enhancing user experience and security. These technologies analyze user behavior to detect unusual activities and offer insights, helping users manage finances.

3. Biometric Authentication

Adding biometric authentication like fingerprint or facial recognition improves security and simplifies the login process. It’s a popular trend, meeting the demand for secure, convenient access.

4. Voice-Activated Transfers

Voice commands are gaining popularity in digital payments, with users able to make transactions hands-free. Adding voice-activated transfers can make your app more accessible and user-friendly, especially in regions with high voice-assistant usage.

By addressing these challenges and keeping up with the latest development trends, you’ll build a money transfer app that not only meets current user expectations but also sets your app up for future success.

Create Your Money Transfer Application with Confidence

Building a money transfer app requires precision, innovation, and trust. At BoomDevs, we specialize in crafting secure, high-performing money transfer solutions that empower businesses to offer seamless, user-friendly experiences. Our team brings extensive expertise in fintech development, handling every step—from design and technology selection to rigorous testing and regulatory compliance—ensuring that your app meets the highest industry standards.

With BoomDevs, you’ll have access to cutting-edge security features, advanced integrations, and a scalable, future-proof infrastructure tailored to your business needs. Ready to bring your app to life? Let BoomDevs guide you in creating a money transfer application with confidence.

Why Trust BoomDevs with Your Money Transfer App Development?

Choosing the right partner is essential in building a reliable, secure money transfer app. At BoomDevs, we prioritize transparency, expertise, and efficiency to ensure your project is completed with excellence and peace of mind. Here’s why BoomDevs stands out:

- Clear Timeline and Milestones: From the outset, we provide a detailed project roadmap, outlining each phase and expected completion dates. Our commitment to on-time delivery means you’ll always know exactly where your project stands, so you can plan your launch with confidence.

- Transparent Pricing with No Hidden Costs: BoomDevs values transparency, so our pricing model is straightforward and free of hidden fees. We offer a detailed cost breakdown so you understand exactly what each phase entails and feel confident about your investment.

- Expert Team with Fintech Experience: Our team consists of highly skilled developers, UX/UI designers, and security experts with specialized experience in fintech and money transfer applications. This ensures your app meets high standards of functionality, security, and compliance, tailored to industry needs.

With BoomDevs, you get a development partner dedicated to making your money transfer app a trusted solution for users, combining experience with customer-centric values to bring your vision to life. Ready to build your app with confidence? BoomDevs is here to help every step of the way.

Let’s Discuss Your Project.

Get a Quote.

Frequently Asked Questions: [How to Create a Transaction App]

Q1: What makes a money transfer app successful in today’s market?

A1: A successful money transfer app prioritizes security, user experience, and reliability. Features like real-time notifications, low transaction fees, and multi-currency support enhance user satisfaction. Seamless integration with banking APIs and compliance with financial regulations further boost an app’s credibility, making it dependable for users.

Q2: How can blockchain technology benefit money transfer apps?

A2: Blockchain offers enhanced security and transparency in transactions, reducing the risk of fraud. It also supports faster cross-border payments with minimal fees, making it a game-changer for international transfers. By incorporating blockchain, money transfer apps can provide secure and efficient transactions while ensuring traceability.

Q3: What role does AI play in modern money transfer apps?

A3: AI improves security and user personalization. It enables advanced fraud detection by analyzing user behavior and identifying suspicious patterns. Additionally, AI can offer personalized recommendations, helping users track spending or find cost-saving transfer options, ultimately creating a more tailored and safe experience.

Q4: Are biometric features important for money transfer apps?

A4: Yes, biometrics like fingerprint or facial recognition add a crucial layer of security and convenience. Users prefer biometrics for fast, secure access to their accounts without the need to remember passwords, making it both user-friendly and highly secure against unauthorized access.

Q5: What is the future of cross-border transfers in money transfer apps?

A5: Cross-border transfers are evolving to be faster, cheaper, and more transparent. Technologies like blockchain and currency exchange APIs make international transactions simpler and less expensive. Future trends may include real-time transfers with minimal fees, expanding accessibility to underserved regions globally.

Q6: How can a money transfer app ensure regulatory compliance?

A6: Ensuring compliance involves integrating KYC (Know Your Customer) and AML (Anti-Money Laundering) standards. This includes verifying user identities and monitoring transactions to prevent illegal activities. Regular updates to align with local and international regulations also help maintain a compliant, trusted service.

Q7: What are some common mistakes to avoid when developing a money transfer app?

A7: Avoiding unclear user interfaces, weak security measures, and overly complex registration processes is key. Many apps fail due to lack of user-centric design or inadequate testing. Building with scalability in mind and thoroughly testing for security vulnerabilities helps ensure a smooth, trusted app experience.

Wrapping Up:

Creating a successful money transfer app requires attention to security, user needs, and market trends. By following the right steps on how to create a money transfer app, you can deliver a solution that stands out in today’s competitive landscape. Prioritize a seamless experience, regulatory compliance, and innovative technology to build trust and engage users. With the right partner, your app can become a trusted tool for fast, secure financial transactions.

Now, ready to turn your money transfer app idea into reality? BoomDevs has the expertise and innovation-driven approach to bring your project to life with confidence. Our team specializes in secure, high-quality app development, guiding you through every step—from initial planning to post-launch support. Let’s make your vision a success. Get in touch today and discuss how BoomDevs can elevate your app idea into a thriving, user-loved solution.

Read More Articles: