Digital transformation in corporate banking is no longer optional; it’s essential for staying competitive. It’s more than adopting new tech—it’s about reshaping how banks operate and serve customers.

As customer expectations shift, banks must deliver faster, more personalized services while managing costs. Technologies like AI, blockchain, and cloud computing drive digital transformation, enabling flexibility, efficiency, and a focus on customer needs.

This article covers how AI transforms corporate banking operations, digital transformation trends, the benefits of digital transformation for corporate banks, and the challenges banks face.

Key Takeaways

- Digital transformation helps banks to stay competitive, meet customer needs, and offer better services.

- Technologies like AI, cloud computing, and blockchain help streamline operations, reduce costs, and enhance personalized services.

- Banks can enhance efficiency and build customer trust by focusing on customer-centric services, automation, and strong cybersecurity.

- Collaborating with fintech companies speed up innovation, allowing banks to offer advanced, seamless services to their clients.

- Digital transformation boosts customer experience, saves costs, improves risk management, and strengthens market position.

What is Digital Transformation in Corporate Banking?

Digital transformation in corporate banking means enhancing services using digital tools like AI, data analytics, blockchain, and cloud computing. This allows banks to work faster, reduce costs, and offer personalized, secure experiences to customers.

By automating tasks and improving data access, banks achieve quicker transactions and safer data storage, creating a more efficient, customer-friendly approach. A strong online presence and effective tools are essential for banks to improve digitally. Explore our Website Design and Development Services at BoomDevs to integrate these innovations into your banking operations.

Fintech Industry Growth: Revenue Statistics

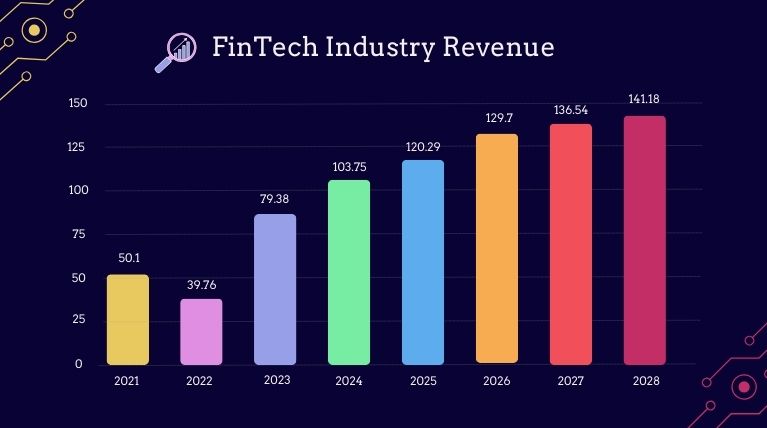

The fintech industry uses technology to simplify and speed up financial services, and experiencing rapid growth as shown by rising revenues.

According to Statista, the global fintech industry’s revenue is projected to reach approximately $189.91 billion by 2028, driven by digital payments, online lending, and advances in AI and blockchain technologies.

Another report expects fintech to hit $460 billion in revenue by 2025, emphasizing the need for traditional banks to adopt digital transformation to stay competitive.

The chart below shows the growth and highlights how banks can benefit by embracing digital solutions.

Source: Statista Market Insights

For a deeper understanding of fintech profitability, check out our article on How Does Fintech Make Money?

Why is Digital Transformation in Corporate Banking Important?

Digital transformation in corporate banking is important for the financial industry’s success. It helps banks meet customer expectations, improve efficiency, and stay competitive. By adopting new technologies like corporate banking digitalization, banks can enhance security, make data-driven decisions, and adapt quickly to market changes.

For those seeking expert guidance in navigating these technological changes, consulting services such as Fintech Management Consulting can provide valuable insights and support throughout the transformation process.

Key Reasons for Importance:

- Meets customer expectations for fast and personalized services.

- Improves efficiency by automating processes.

- Helps banks stay competitive against fintech firms.

- Enhances security to protect sensitive data.

- Enables data-driven decisions for better business strategies.

- Allows quick adaptation to market changes and regulations.

Key Aspects of Digital Transformation in Corporate Banking

Digital transformation in corporate banking is reshaping the industry. Banks focus on improving their operations, customer service, and overall competitiveness.

Several key aspects drive this transformation including AI in banking, Cloud migration in banking, and Banking technology transformation. Each plays a crucial role in how banks adapt to the digital age.

1. Customer-Centric Digital Services

One of the most important aspects of digital transformation is creating customer-friendly digital services. Corporate clients expect easy access to banking services via online platforms and mobile apps. Banks are focusing on providing a seamless, personalized experience that meets the needs of their clients.

A great example is the integration of chatbots, which can significantly improve customer interaction and service efficiency. How Chatbots Help in Fintech can further illustrate how these AI-driven tools enhance customer service in corporate banking.

2. Automation and Artificial Intelligence (AI)

Automation helps banks streamline operations, reduce manual work, and enhance efficiency. With AI, banks can predict customer needs, automate repetitive tasks like document processing, and improve decision-making by analyzing large amounts of data. This allows banks to be more agile and responsive.

3. Cloud Technology

Cloud computing in the financial services industry allows banks to store and process data flexibly and cost-effectively. Moving to the cloud enables better scalability, improves data access, and helps banks stay agile in responding to customer demands. Additionally, cloud technology enhances collaboration among different departments within the bank.

4. Cybersecurity and Data Privacy

With more digital services comes an increased focus on cybersecurity. Protecting sensitive financial data is essential for corporate banks. Strong encryption, secure authentication methods, and compliance with regulations are all crucial in maintaining client’s trust.

5. Big Data and Analytics

Data is at the core of decision-making in modern banking. Banks can better understand customer behaviour, manage risks, and identify growth opportunities by analysing large datasets. Predictive analytics also help banks offer more tailored solutions to their corporate clients.

6. Blockchain and Digital Payments

Blockchain technology is gaining traction in corporate banking, particularly for secure, transparent, and efficient transactions. It helps streamline cross-border payments and reduces transaction costs. Digital payment solutions, powered by blockchain, offer faster and more secure methods for handling large financial transactions.

7. Regulatory Technology (RegTech)

Compliance with regulations is a major concern for corporate banks. RegTech, or regulatory technology, helps banks automate compliance processes, reducing the risk of errors and improving accuracy in meeting legal requirements. It also helps banks stay updated with constantly changing financial regulations.

8. Collaboration with Fintechs

Corporate banks increasingly collaborate with fintech companies to accelerate their digital transformation. Fintechs offer innovative solutions like payment processing, lending platforms, and digital onboarding tools, allowing banks to provide their clients with more diverse and efficient services.

9. Digital Culture and Workforce Transformation

Beyond technology, banks must promote a digital culture within their workforce. Employees need the right skills and mindset to adapt to new digital tools. This includes training in new technologies and encouraging a culture of innovation and agility.

10. Sustainability and Green Banking

Another growing aspect is the integration of sustainable practices through digital transformation. Banks use technology to reduce their carbon footprint and offer green financial products, responding to the rising demand for eco-friendly banking services.

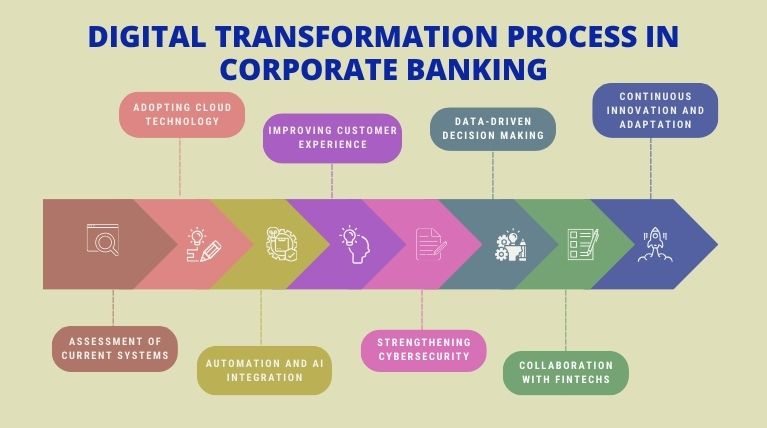

Digital Transformation Process in Corporate Banking

Digital transformation in corporate banking is a comprehensive process that uses technology to improve efficiency, customer experience, and overall operations of banks. This transformation is a key part of the corporate banking digitalization process. It involves adopting digital tools and innovative solutions that allow banks to remain competitive in a rapidly evolving financial landscape.

Here’s a simplified breakdown of the process:

1. Assessment of Current Systems

Corporate banks start by evaluating their existing systems. This involves identifying outdated systems, manual processes, and areas where digital solutions can provide improvements. This step helps in understanding the gaps that need to be addressed.

2. Adopting Cloud Technology

Banks are increasingly moving their data and services to the cloud. Cloud solutions allow for scalable operations, reducing costs while ensuring banks can quickly adapt to growing customer demands. This also ensures better security and easier access to data.

3. Automation and AI Integration

Automating repetitive tasks like transaction processing, compliance checks, and customer service allows banks to operate more efficiently. Artificial intelligence (AI) analyzes data and predicts customer needs, making services more personalized and streamlined.

4. Improving Customer Experience

Digital tools like mobile apps and online banking platforms give customers easier access to services. Banks use these tools to offer 24/7 service, provide real-time insights, and create a seamless banking experience. This is key in attracting and retaining corporate clients who need fast, secure, and reliable services.

5. Strengthening Cybersecurity

As digital adoption increases, so do the risks. Banks prioritize cybersecurity by implementing advanced security measures, encryption, and compliance with strict regulatory standards. Protecting sensitive financial data is essential in maintaining trust.

6. Data-Driven Decision Making

Banks collect and analyze large amounts of data. This data improves decision-making, creates tailored services, and enhances risk management. Predictive analytics help banks predict market trends and client behaviours, allowing them to respond proactively.

7. Collaboration with Fintechs

To increase innovation, many corporate banks collaborate with fintech companies. Fintech Software Development Services can offer specialized digital solutions that banks need, such as blockchain integration, digital payments, and AI-driven credit assessment. This partnership allows banks to integrate new technologies more quickly and efficiently.

8. Continuous Innovation and Adaptation

The transformation doesn’t stop with implementation. Corporate banks must continuously innovate, test new technologies, and adapt to customer needs and regulatory environments. Staying agile is important in maintaining a competitive edge.

What are the Benefits and Challenges of Digital Transformation in Corporate Banking?

Digital transformation in corporate banking helps banks improve their services and operations. It offers new ways to connect with customers and manage resources.

However, it also brings challenges that banks must face. Understanding both the good and the bad is important for banks to succeed in today’s fast-changing financial world.

Benefits of Digital Transformation in Corporate Banking

Digital transformation in corporate banking offers numerous advantages that can significantly improve how banks operate and serve their clients.

Here are the benefits of digital transformation for corporate banks—

1. Improved Customer Experience

Digital tools allow banks to offer better services to their clients. Customers can access their accounts anytime through online platforms and mobile apps. This convenience leads to greater satisfaction and loyalty.

2. Increased Efficiency

Automating tasks like processing payments and managing documents saves time and reduces errors. This efficiency means banks can serve more clients without additional staff. It leads to saving costs.

3. Faster Decision-Making

With access to real-time data and analytics, banks can make quicker decisions. This agility allows them to respond rapidly to market changes and customer needs. It helps them stay competitive.

4. Enhanced Security

Digital transformation includes advanced security measures to protect sensitive information. By utilizing Fintech App Security Solutions, Banks can further safeguard client data and build high trust in their services.

5. Cost Reduction

By adopting digital solutions, banks can lower operational costs. For example, moving to cloud computing reduces the need for expensive physical infrastructure. It allows banks to invest more in innovation.

6. Better Risk Management

Digital tools help banks analyze data more effectively. This allows them to identify potential risks sooner and take action to reduce them. It ensures safer banking practices.

7. Innovation Opportunities

Digital transformation opens the door to new services and products. Banks can create innovative solutions tailored to their clients’ needs. It helps them stay relevant in a fast-changing market.

8. Sustainability Initiatives

Many banks use digital tools to adopt greener practices. This includes reducing paper use and offering sustainable financial products, appealing to environmentally conscious customers.

9. Personalized Services

Digital tools allow banks to gather and analyze customer data. It enables them to offer personalized services. Tailoring products and recommendations for each client helps build stronger relationships and meet their specific needs.

10. Greater Accessibility

Digital banking platforms make services accessible to a wider range of clients, including those in remote areas. This inclusivity allows banks to reach more customers and expand their market.

Challenges to Achieving Digital Transformation in Corporate Banking

Digital transformation in corporate banking is essential to stay competitive. However, banks face several challenges in this journey. By understanding these obstacles, banks can develop strategies to overcome them. Embracing change will lead to better services and a stronger future in the digital age, particularly through effective banking technology transformation.

Here are the key obstacles—

- Legacy Systems and Infrastructure: Many banks operate on outdated technology that is difficult to update. This can hinder innovation and slow down progress.

- Cybersecurity Threats: As banks move to digital platforms, they become more vulnerable to cyberattacks. Protecting sensitive data is a top priority.

- Regulatory Issues: The banking sector is subject to strict regulations. Navigating compliance while adopting new technologies can be complicated and time-consuming.

- Data Privacy Concerns: As data collection increases, banks must take responsibility to protect customer information. It ensures compliance with data privacy laws.

- Cultural Resistance: Employees may resist changes to established processes. This reluctance can slow down the adoption of new technologies and practices.

- High Implementation Costs: Digital transformation requires significant investment in technology and training. Budget constraints can limit progress.

- Talent Shortage: Digital banking needs more skilled professionals. Finding and retaining talent with the right expertise can be a major challenge. Banks often struggle to Hire the Best Fintech Developers to meet the demand for specialized skills required for digital transformation.

- Integration with Existing Systems: New technologies must work with current systems. Ensuring compatibility can be difficult and may require additional resources.

- Customer Adoption: Customers may be slow to adopt new digital services. Banks need to invest in education and support to encourage usage.

- Managing Digital Transformation at Scale: Implementing changes across a large organization can be complex. Coordinating efforts and ensuring consistent messaging is essential for success.

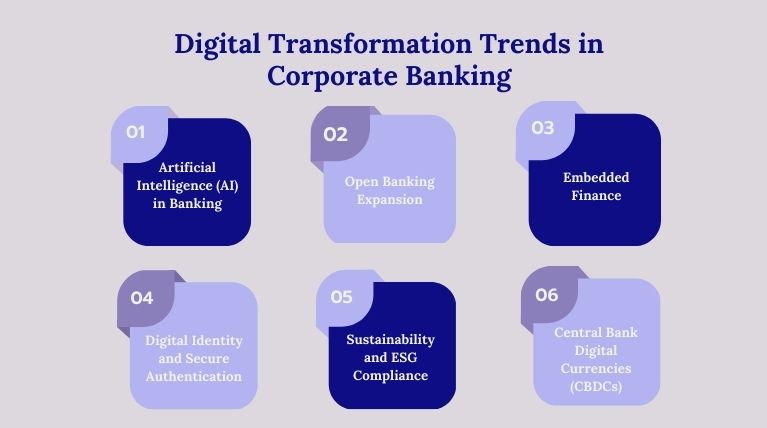

What are the current digital transformation trends in corporate banking?

In 2024, several key digital transformation trends are shaping the landscape of corporate banking. Understanding these trends, including banking innovation trends, is vital for banks aiming to stay competitive and meet customer expectations.

1. Artificial Intelligence (AI) in Banking: Banks use AI to enhance customer service. AI tools like chatbots provide 24/7 support. It improves customer satisfaction while reducing staff workload. AI also helps banks deliver personalized experiences based on customer data and preferences.

2. Open Banking Expansion: Open banking is becoming more common, allowing banks to share customer data securely with third-party providers. This trend encourages innovation and collaboration, giving customers access to more financial services in one place. How to Launch a Fintech aligns with this trend, as Fintech solutions often leverage open banking to create innovative financial products and services. Enhanced payment experiences, including instant transfers and better fraud detection, are notable benefits of this approach.

3. Embedded Finance: Financial services are integrated into non-financial platforms, allowing banks to reach new markets. This means customers can access banking services on other apps or websites. It helps banks reach new customers and offer more personalized products.

4. Digital Identity and Secure Authentication: Digital identity is important for secure transactions. Banks can enhance security and promote financial inclusion by providing users control of their personal data. This is especially important as customers increasingly prioritize privacy.

5. Sustainability and ESG Compliance: Environmental, Social, and Governance (ESG) factors are becoming essential to banking. Customers expect banks to implement affordable practices and provide comprehensive financial solutions. As a result, banks are developing strategies to address these expectations while ensuring regulatory compliance.

6. Central Bank Digital Currencies (CBDCs): Many countries are testing digital versions of their currencies, called CBDCs. These digital currencies could make payments faster and more secure, especially for international transfers.

Examples of Successful Digital Transformation in Corporate Banking

Here are successful examples of digital transformation in corporate banking—

1. J.P. Morgan Chase

In the United States, J.P. Morgan Chase is a leader in digital transformation within corporate banking. They developed a robust digital platform called J.P. Morgan Markets, which allows corporate clients to manage transactions, access market data, and conduct trades seamlessly.

They also introduced innovative solutions like the Automated Clearing House (ACH) for faster payments and digital trade finance services. These initiatives have improved client experience, reduced transaction times, and enhanced overall operational efficiency.

2. Citigroup Inc.

Citigroup, also based in New York City, has made significant strides in digital transformation within corporate banking. Their Treasury and Trade Solutions (TTS) platform offers advanced cash management and trade finance tools.

Citigroup has implemented real-time data analytics, giving businesses better insights into their financial activities, operational efficiency, and enhancing decision-making. These digital tools have helped Citigroup maintain strong relationships with corporate clients.

What is the future of digital transformation in corporate banking?

The future of digital transformation in corporate banking is promising and set for significant evolution. As banks face the pressures of competition from fintechs and changing customer expectations, they leverage increasingly advanced technologies to enhance their services.

- AI Integration: Banks increasingly use artificial intelligence to automate processes, enhance customer engagement, and personalize services. AI-driven banking solutions can analyze data to provide tailored financial advice, revolutionizing AI in banking and enabling more efficient operations.

- Cloud Computing: Cloud services are essential for banks. It allows cloud migration in banking to be more agile, manage data effectively, and improve operational efficiency.

- Banking-as-a-Service (BaaS): This model enables banks to offer services through third-party platforms, facilitating banking technology transformation. It helps banks reach more customers and allows non-banking companies to add financial services to their products.

- Enhanced Customer Experience: Banks focus on creating smooth and user-friendly experiences across different channels. They want to make banking services more reliable and automated in everyday life.

- Regulatory Compliance: As digital transformation progresses, banks must adapt to new regulations while embracing new technologies. They need to maintain trust and avoid penalties to stay competitive.

- Cybersecurity Measures: With increased digital services, banks must focus on strong cybersecurity in banking digitalization to protect customer data and build trust.

Begin Your Banking Transformation Journey Today with BoomDevs

At BoomDevs, we understand that the corporate banking world is changing fast and digital transformation is essential to keep up. Our expert team is here to help you modernize your banking services boosting customer satisfaction and streamlining operations with cutting-edge tech like blockchain and data analytics.

We’ll work with you to identify your needs and integrate solutions that make your services stand out. Start by evaluating your current systems, then partner with us to explore the best ways to enhance your services. Visit our Website Design and Development Services to see how we can help.

Don’t let your bank fall behind. Let BoomDevs guide you on your journey to digital transformation.

Contact us now to get started!

Final Thoughts on the Digital Transformation in Corporate Banking

Digital transformation is crucial for the future of corporate banking digitalization. It reshapes how banks operate and serve customers. By adopting technology, banks enhance services, boost efficiency, and meet client expectations.

Many banks are investing in digital tools that focus on automation, real-time data, and personalized solutions. This keeps customers satisfied, builds trust and loyalty.

However, challenges exist. Banks must smoothly manage regulatory changes and cybersecurity risks related to digital transformation while integrating new technologies. The path to corporate banking transformation requires careful planning and execution.

In conclusion, digital transformation in corporate banking is not just a trend; it’s a necessity for corporate banks. Those who adapt will thrive in an increasingly competitive landscape. Let’s embrace this change together and shape the future of banking.